When I was a little girl, I had a self-made definition of being rich. If I could buy whatever I want without looking at the price tag, I would consider myself as rich. More than 20 years down the line, despite having a dreamy high-paying job, I still feel uncomfortable in buying a non-essential item without checking out the cost. When I wonder whether my definition was unrealistic or whether I still have a long way to go, I couldn’t stop myself from getting enough financial literacy.

Do I want to become rich or do I want to become wealthy?

Talking about money is considered a taboo in the Indian society. Neither children are ever involved in family discussions about money nor is money a subject in school. Probably, talking about money is assumed to make a kid opportunistic and materialistic without realizing that lack of financial knowledge may pull down his future net worth. Even though most of our day-to-day, short term and long term decisions are money-related, the topic of money is perceived to be a non-innocent one.

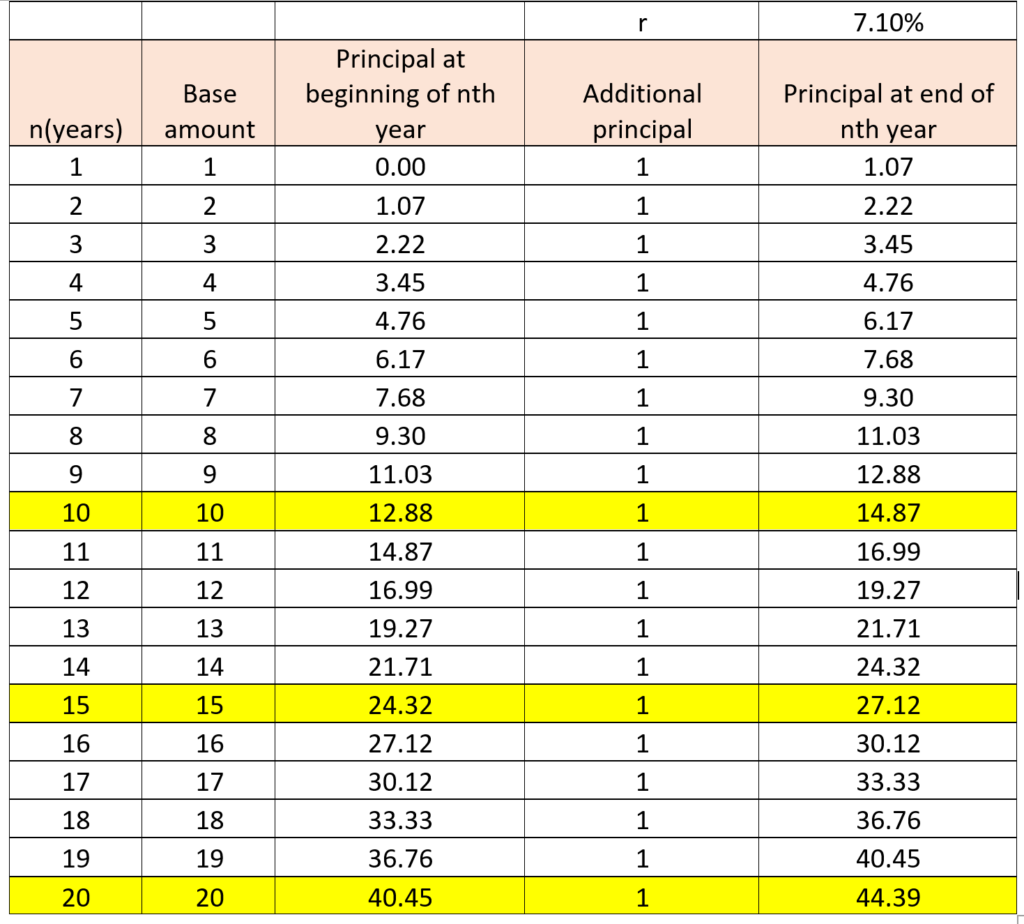

I began my journey in my late 20s, but I am glad that I am able to witness the positive effect of investments and reinvestments. Below are the areas which I believe everyone should have a green tick in their financial report card. The most important concept to understand here is the power of compounding illustrated by the following table.

Early starters tend to be richer than their peers after a period of time as their money grow faster because their investment and income earned from that investment grow together. Reinvesting of interests is the key to maximise savings and become wealthy.

When I calculated how much money had I lost because I didn’t have a PPF account till the age of 25, I was shocked.

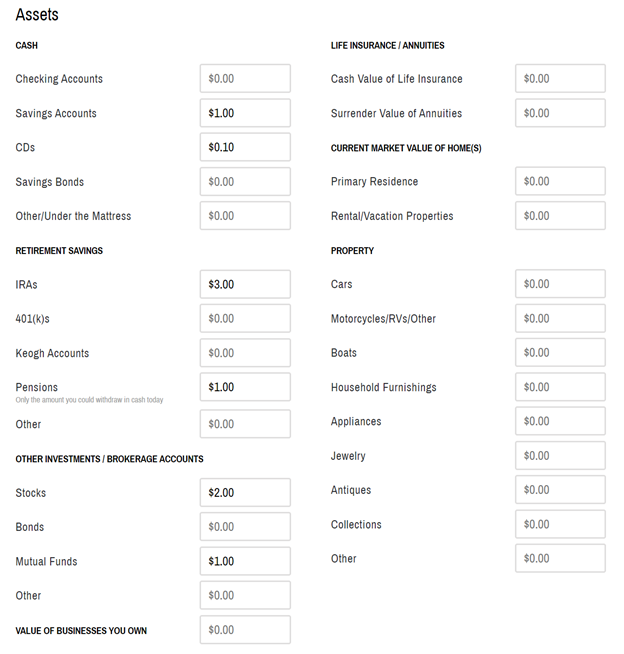

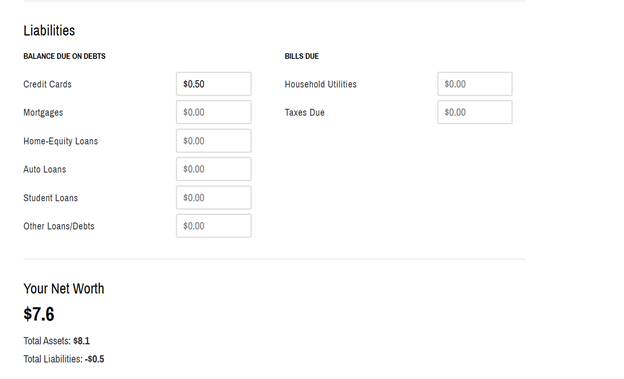

Tangible Net worth calculations

Calculating one’s net worth is one of the best ways to judge the financial trajectory. If the net worth increases with time, it means we are on the right track.

Net worth = Assets – Liabilities

What do you want to become in your life? This is a question which we are asked right since we start getting some sense of the world. I don’t remember any of my classmates including myself giving the answer I want to become RICH/WEALTHY although this seems to be the most logical answer.

People may argue that a rich mindset may be money-minded and opportunistic with high-risk appetite. However, we don’t understand that unless a person is financially capable enough, he cannot be a good supporting hand in helping the relatively poorer family members and friends.

There is a reason why capitalism is being considered a better choice for people who believe in performance-based identity. And mind you, financial literacy makes us better equipped in such a world because with increasing inflation, our money in savings account is only making us poorer with time.

Let us take a pause and ask a few questions and analyse our financial performance –

- Do we truly understand and appreciate the power of compounding?

- Is there timely improvement in my net worth?

- Am I able to get maximum tax benefits with my investment portfolio?

- Am I investing in stock market as per my risk appetite?

- Do I have a retirement plan and a term insurance to take care of my family?

- Why is buying a house using debt and avoiding the rents more helpful than paying rents without getting the asset to your name over time?

- Why are mutual funds becoming important in one’s investment portfolio?

- Can you become wealthy by doing a job throughout your life?

- Which one is a better way to save more – reducing expenses or increasing income?